Chiba Bank and LAC Agree to Introduce AI Fraudulent Transaction Detection Solution to Fight Special Fraud and Other Financial Crimes AI Fraudulent Transaction Detection Solution to Fight Special Fraud and Other Financial Crimes

~Using AI to Detect Fraudulent Transactions and Fraudulent Accounts, Aiming to prevent crime and reduce damage

株式会社ラック

LAC Corporation (headquartered in Chiyoda-ku, Tokyo; Itsuro Nishimoto, President; hereinafter "LAC") has agreed to provide Chiba Bank, Ltd. (headquartered in Chuo-ku, Chiba-shi, Chiba; Tsutomu Yonemoto, President; hereinafter "Chiba Bank") with an AI-based fraud detection solution, "AI Zero Fraud," to counter fraudulent withdrawals in special frauds, such as those used to swindle cash cards from the elderly, and fraudulent accounts*1 used by criminals to receive the funds they have stolen. The system will be developed and introduced in November 2023, and operation is scheduled to start in 2024.

1 An account used to transfer funds obtained through criminal activities. These accounts are also called "perpetrator accounts" because they were opened with forged IDs for the purpose of criminal use or illegally acquired by criminals through transfer or sale from third parties.

In recent years, the methods of special fraud have become increasingly sophisticated, and the amount of damage caused by special fraud in 2022 reached approximately 37 billion yen*2, which is still high and has begun to increase again. In the first half of 2023, Internet banking fraudulent money transfers amounted to approximately 3 billion yen*3, the worst pace in history. The number of fraudulent accounts used by criminals to receive these special frauds and Internet banking fraudulent remittances has also increased dramatically over the past few years*4, making financial crime in Japan a major threat.

As a countermeasure against special fraud and unauthorized accounts, Chiba Bank is working to enhance its fraudulent transaction detection system to detect transactions that are highly suspicious of criminal activity. In order to utilize AI in a system that analyzes and determines the fraud risk of transactions based on the characteristics of transactions conducted by criminals, Chiba Bank is conducting a proof-of-concept (PoC) experiment with "AI Zero Fraud," a fraudulent transaction detection solution provided by the Financial Crime Control Center (FC3: Financial Crime Control Center) of LAC. After conducting a proof-of-concept (PoC) experiment with AI Zero Fraud, a fraudulent transaction detection solution provided by LAC's Financial Crime Control Center (FC3), LAC evaluated its high accuracy in detecting fraudulent transactions and fraudulent accounts in special frauds, and reached an agreement to introduce this system.

Through the provision of AI Zeroflood, LAC will support Chiba Bank's efforts to combat special fraud and fraudulent accounts by enhancing its fraudulent transaction countermeasures.

2 National Police Agency, Special Fraud Recognition and Arrests in 2022 (finalized version)

https://www.npa.go.jp/bureau/criminal/souni/tokusyusagi/tokushusagi_toukei2022.pdf

3 National Police Agency, Threats to Cyberspace in the First Half of 2023

https://www.npa.go.jp/publications/statistics/cybersecurity/data/R05_kami_cyber_jousei.pdf

4 Japanese Bankers Association Questionnaire on account abuse

https://www.zenginkyo.or.jp/fileadmin/res/hanzai/statistics/news350925_5.pdf

Fraudulent transaction detection solution "AI Zero Fraud

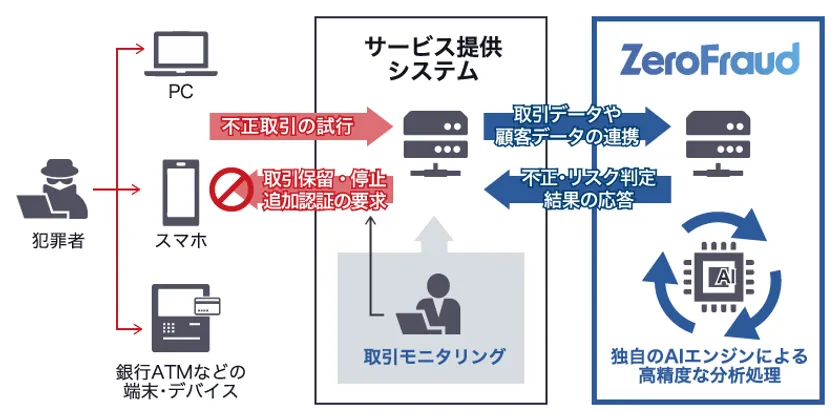

AI Zero Fraud is a countermeasure solution that uses artificial intelligence (AI) to analyze the transaction behavior of financial service users and detect financial crimes with high accuracy. It supports financial service providers in their efforts to prevent damage in financial crimes such as unauthorized money transfers through Internet banking and special fraud*5 via ATMs. It also supports efforts to prevent crimes in which services are abused through a function that can detect and discover fraudulent accounts used by criminals to transfer illicit funds obtained by criminals.

5 A technique in which criminals cheat people out of their cash cards and use ATMs to make withdrawals, such as deposit and savings fraud and cash card fraud theft.

Fig. 1 Image of AI Zero-Fraud

● AI enables more flexible detection with higher accuracy than conventional methods.

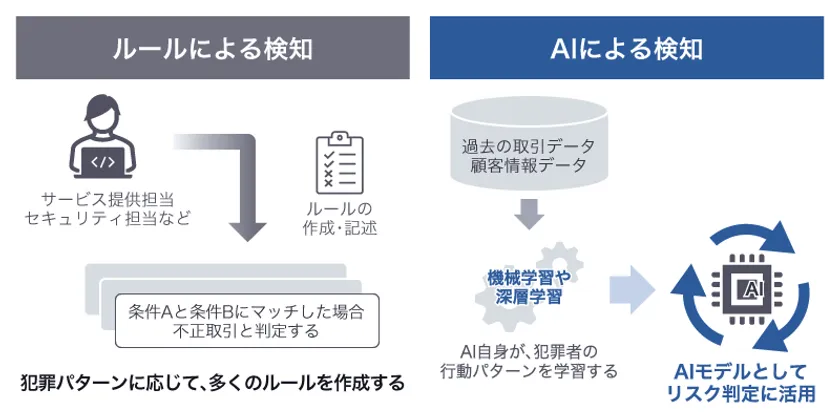

Conventional fraud detection systems generally use rules to detect specific user behavior. This is done by detecting transactions that are suspected of being criminal when certain conditions are met during fraudulent transactions by criminals, based on data such as user bank account access information and transaction information. In contrast, the AI-based detection mechanism allows AI to learn the characteristics of banking transactions and analyze transaction behavior to detect suspected fraud.

In a system that uses rules, it is easy to understand the reason for detection because of specific conditions set by a human, but it is difficult to set complex conditions. On the other hand, AI-based systems can detect with a high degree of accuracy financial crimes that have become increasingly sophisticated in recent years, because AI analyzes transactions from a more detailed perspective after learning the characteristics of each transaction.

Figure 2: Difference in Fraud Detection Mechanisms

About The Chiba Bank, Ltd.

The Chiba Bank, Ltd. is a regional bank based in Chiba, Japan, with one of the largest asset bases in Japan and one of the most profitable regional banks in the world. The Chiba Bank Group's 17 group companies work together to meet the diverse needs of local customers by leveraging the capabilities of each company, including securities and asset management, research and consulting, leasing and venture capital, credit cards, outsourcing and job placement, credit guarantee and credit management, and regional trading companies.

About LAC Corporation

Lack provides services to solve a variety of social and business challenges with its extensive experience and state-of-the-art technologies in cyber security and system integration. Since its inception, the company has been involved in the development of infrastructure systems that support Japanese society, including financial and manufacturing industries. In recent years, it has also been involved in the latest IT services suited to the DX era, such as AI, cloud computing, and teleworking. Since launching Japan's first information security service in 1995, we have been at the forefront of the latest cyber-attack countermeasures and incident response, including JSOC, one of the largest security monitoring centers in Japan, Cyber Emergency Center, vulnerability assessment, penetration testing, and IoT security. LAC is a leading company in the information security field.

LAC and LAC are registered trademarks or trademarks of LAC Corporation in Japan and other countries.

All other company names, organization names, product names, etc. mentioned herein are registered trademarks or trademarks of their respective companies.

All information is current at the time of publication and is subject to change without notice. Information is subject to change without notice.

- Category:

- Corporate Trends